Cargojet Provides Update on Fleet Strategy

MISSISSAUGA, ON, January 15, 2024 – Cargojet Inc. (“Cargojet” or the “Corporation”) (TSX:CJT) today provided an update on its ongoing efforts to further streamline its fleet strategy and the associated impacts to capital expenditures and cashflows.

“Throughout 2023 we exercised caution in deploying growth capital given the softer economic conditions” said Dr. Ajay Virmani, Executive Chairman, “Forecasts continue to indicate that the international air cargo market will remain soft in the short to medium term and deploying B-777s into the market would not be strategically prudent. We have decided to exit our commitments for the four remaining B-777 aircraft, while continuing to flex our B767 fleet to accommodate our organic growth strategy”, noted Dr. Virmani. “Cargojet has substantially completed the operational groundwork to be able to enter the B-777 market should economic conditions change. Cargojet has also retained the rights to provide the optionality for future conversion slots”.

“The holiday season performance for 2023 was in line with our expectations” noted Jamie Porteous, Co-Chief Executive Officer. “With our optimized fleet strategy and cost efficiencies gained throughout 2023, we are well positioned to deliver strong cashflows and shareholder value” commented Pauline Dhillon, Co-Chief Executive Officer.

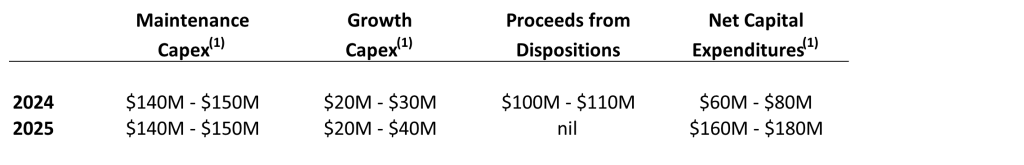

As a further update to the above comment, the Corporation is providing the following estimated capital expenditures targets for the years ending December 31, 2024 and 2025 (see “Notice on Forward-Looking Statements” below):

Cargojet is not expecting to incur any meaningful Growth Capital Expenditures in 2024. However, the Corporation continues to monitor macro-economic conditions for opportunities to deploy capital if profitable growth opportunities emerge in the future.

Cargojet will continue with a disciplined approach to capital allocation, focusing on four key principles;

- Maintain dividend growth;

- Continue to identify growth opportunities to deploy capital that meet its margin requirements;

- Maintain a share buyback program under its normal course issuer bid (“NCIB”). The Corporation will determine the ultimate size of the buyback program based on available growth opportunities and subject to market conditions; and

- Target Net Debt to Adjusted EBITDA Leverage Ratio(1) of 1.5x to 2.5x (2022 Leverage Ratio of 2.1).

Under its NCIB, the Corporation has purchased for cancellation an aggregate of 366,408 voting shares as at December 31, 2023 for an average purchase price of $104.66, at a total cost of $38.3 million.

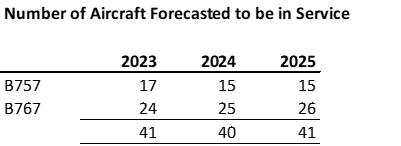

The table below sets forth the Corporation’s cargo operating fleet as at December 31, 2023 as well as the expected operating fleet requirements for the next two years (see “Notice on Forward-Looking Statements” below):

As previously disclosed, the Corporation has four surplus B757 freighters and is exploring options such as dry lease or ultimate sale of these aircraft. The potential sale of these four B757’s is not anticipated to have a material impact on Revenues and/or Adjusted EBITDA(1). In the event that the Corporation enters into a leasing agreement, the Revenue and Adjusted EBITDA would increase in accordance with typical market terms and conditions for similar aircraft. The fleet table above assumes two aircraft are dry leased and the remaining two B757’s are sold.

Cargojet currently owns the feedstock for two B767’s and plans to convert them as the demand begins to recover over the next couple of years. Management believes that the current fleet plan will be sufficient to meet its short to medium-term objectives and Cargojet is well positioned to scale up operations as the economic cycle returns to growth.

All references to “$” in this press release are to Canadian dollars.

(1)Adjusted EBITDA, Growth Capital Expenditures, Maintenance Capital Expenditures, Net Capital Expenditures and Net Debt to Adjusted EBITDA Leverage Ratio are non-GAAP measures and ratios. See “Non-GAAP Financial Measures” below.”

—————

TRANSCOM ISP – Free Sigma HSE Email

Level 6 Domain Names are FREE – Register Now.