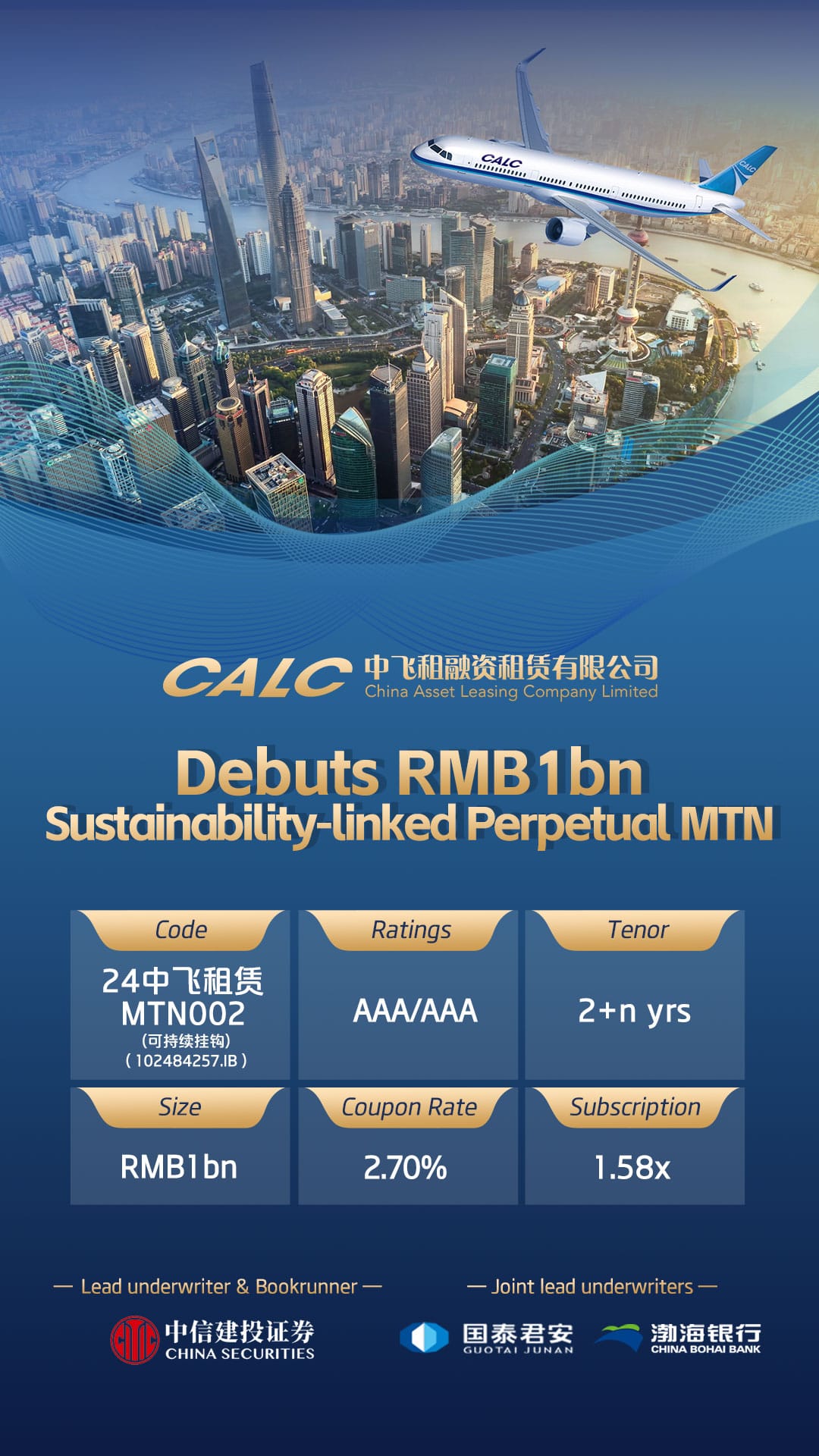

CALC (TJ) Debuts RMB1bn Sustainability-linked Perpetual MTN with a record-low coupon rate of 2.7%

(Hong Kong and Tianjin, China – 26 Sept 2024) – China Aircraft Leasing Group Holdings Limited (“CALC“, together with its subsidiaries, the “Group“; SEHK stock code: 01848), a full value chain aircraft solutions provider for the global aviation industry, is pleased to announce that its wholly-owned subsidiary China Asset Leasing Company Limited (“CALC (TJ)” or the “Company”) has successfully issued its sustainability-linked medium-term notes with a term of 2+N years (the “Perp.”) and the amount of RMB1billion. It attracted a subscription application of 1.58 times, with coupon rate hitting a new low of 2.7% compared with the company’s last bond issuance in the 1H2024. This fully demonstrated CALC (TJ)’s fund-raising ability as a leading lessor in China’s aviation finance market, and the widely recognition of its commitment to sustainable investment and green finance development.

The issuer CALC (TJ) has received AAA ratings from China’s authoritative credit rating agencies China Cheng Xin International Credit Rating Co., Ltd(“CCXI”) and China Dagong International Credit Rating Co., Ltd. (“Dagong International”) respectively, with a stable outlook, while the Perp. received AAA rating from Dagong International as well, which affirmed the comprehensive strength of CALC (TJ) in terms of asset quality, business model, professional operation capabilities and development prospects.

The positive market response with a competitive coupon rate reflected the long-term support from investors of CALC (TJ) which allowed the company to capitalize on strong market demand and favorable market conditions. With the continuous improvement of policies and the ongoing innovation of market mechanisms, green financing will play an increasingly important role in the global economic transformation. The issuance laid a solid foundation for CALC (TJ)’s sustainable operation and drive the company to actively grasp the huge market opportunities brought about by the multi-field development initiated by the “14th Five-Year Plan” of the national civil aviation.

The Perp. was issued under CALC’s RMB Medium Term Note Program. CSC Financial Co., Ltd. was the lead underwriter and bookrunner for this offering while the joint lead underwriters for the offering were Guotai Junan Securities Co., Ltd. and China Bohai Bank Co., Ltd.

—————

TRANSCOM ISP – Free Sigma HSE Email

Level 6 Domain Names are FREE – Register Now.