Azul Crystalizes the Successful Restructuring with Bondholders, Lessors and OEMs

São Paulo, January 28, 2025 – Azul S.A. (“Azul” or “Company”) (B3: AZUL4, NYSE: AZUL) today announces that it has completed the restructuring of its obligations with substantially all bondholders, lessors and OEMs, and the closing of the previously announced offering of US$525 million in aggregate principal amount of Floating Rate Superpriority Notes due 2030 (“Superpriority Notes”) issued by Azul Secured Finance LLP, together with its previously announced exchange offers.

The comprehensive restructuring and recapitalization included a structured financing plan, focused on improving liquidity and cash generation, and reducing leverage, with almost US$1.6 billion in debt being extinguished from the balance sheet, with an additional US$525 million principal amount of capital raised, as summarized below:

Restructuring with Lessors, OEMs and Other Suppliers

The restructuring with lessors and OEMs contemplated:

- Elimination of equity issuance obligations owed to lessors and OEMs totaling approximately US$557 million, in exchange for 94 million new AZUL4 preferred shares in a one-time issuance to be completed in the first quarter of 2025.

- Extinguishment of US$243.6 million aggregate principal amount of existing notes held by certain lessors and OEMs (the “2030 Lessor/OEM Notes”) in exchange for other commercial considerations.

- Exchange of the remaining 2030 Lessor/OEM Notes for new unsecured notes due in 2032 and an option to pay interest in kind.

- Binding definitive agreements with lessors, OEMs and other suppliers, enhancing additional cash flow improvements of over US$300 million across 2025, 2026 and 2027.

By achieving these results, Azul was able to access the full gross proceeds of the Superpriority Notes, including the additional US$100 million that had been reserved upon satisfaction of certain conditions.

Bondholder Restructuring and Recapitalization

The restructuring and recapitalization transactions with bondholders contemplated:

- Initial funding: US$150 million funded in October 2024, which was fully repaid today.

- 2030 Superpriority Notes: US$525 million principal amount, issued today and maturing in 2030. Interest on the principal amount can be paid in kind or in cash at Azul’s election.

- Equitization into preferred shares (including represented by ADRs) of US$784.6 million of the new exchanged 2029 and 2030 notes (“New Exchange Notes”), as follows:

- 35.0% of the principal amount of the New Exchange Notes no later than April 30, 2025; and

- 12.5% of the principal amount of the New Exchange Notes upon completion of an equity offering raising net proceeds of at least US$200 million.

- The remaining 52.5% of the principal amount of the New Exchange Notes shall be exchanged no later than April 30, 2025 into new exchangeable notes with interest of 4.0% in cash plus 6.0% PIK.

Summary of the Accounting Impact of the Restructuring and Recapitalization

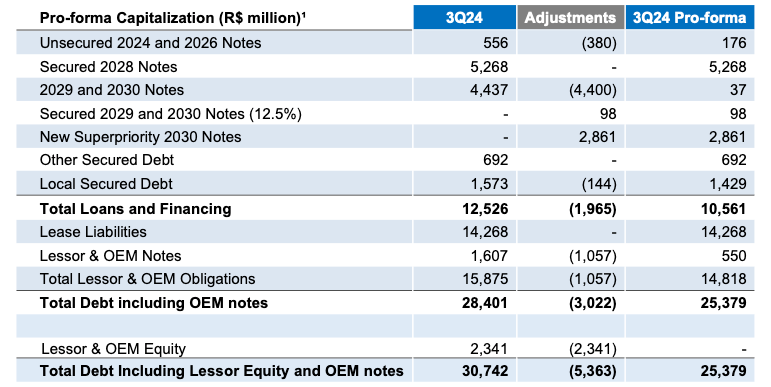

The transactions described herein significantly improve Azul’s capital structure by eliminating not only the lessor and OEM equity issuance obligations but also Azul’s secured second out 2029 and 2030 notes (subject to the equitization terms and conditions of the new 2029 and 2030 notes), as well as a portion of the 2030 lessor and OEMs Notes, as illustrated in the table below:

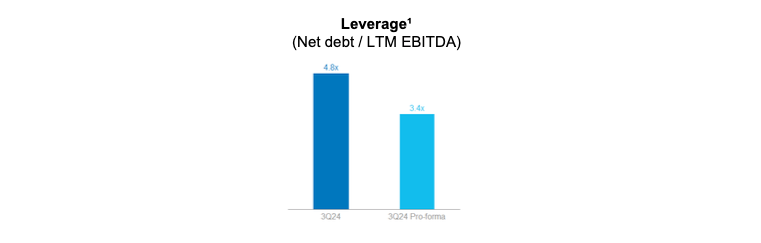

With this debt reduction, Azul’s leverage drops significantly from 4.8x (4.4x excluding the lessors and OEMs equity issuance obligations) to 3.4x considering last twelve months’ EBITDA in 3Q24 of R$5.8 billion, as demonstrated below:

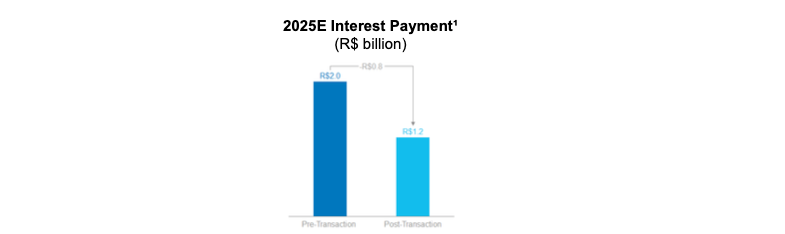

Furthermore, the transactions described herein significantly increase Azul’s cash generation by reducing its interest payment by almost R$1.0 billion in 2025 and beyond, as demonstrated below:

¹Considers the 3Q24 closing foreign exchange rate of R$5.45

—————

TRANSCOM ISP – Free Sigma HSE Email

Level 6 Domain Names are FREE – Register Now.